Tax Percentage 2025

Tax Percentage 2025. 9, 2025 washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year. Quick access to tax rates for individual income tax, corporate income tax, property tax, gst, stamp duty, trust, clubs and associations, private lotteries duty, betting and.

You pay tax as a percentage of your income in layers called tax brackets. Use the simple tax calculator to work out just the tax you owe on your taxable income for the full income year.

2025 Tax Brackets (Taxes Due In April 2025) The 2025 Tax Year, And The Return Due In 2025, Will Continue With These Seven Federal Tax Brackets:

In 2025, a single filer making $45,000 of taxable income pays a 10% tax rate on $11,000 of their earnings, a 12% tax rate on the portion of the earnings between $11,001 and $44,725, and a 22%.

Cit Rebate Of 50% Of Tax.

To achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2025.

Singapore Income Tax Calculator 2025.

Images References :

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2025 year of assessment Just One Lap, Income in america is taxed by the federal government, most state governments and many local governments. How much tax you’ve paid in the current tax year;

Source: robertorodri.pages.dev

Source: robertorodri.pages.dev

Nys Tax Brackets For 2025 Megen Sidoney, Federal income tax rates and brackets. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Source: nicholasbrown.pages.dev

Source: nicholasbrown.pages.dev

Oregon State Tax Rate 2025 Jandy Lindsey, Use the income tax estimator to work out your. Welcome to the 2025 income tax calculator for singapore which allows you to calculate income tax due, the effective tax rate and.

Source: www.nbcnews.com

Source: www.nbcnews.com

Here's where your federal tax dollars go NBC News, Credits, deductions and income reported on other forms or schedules. Use the simple tax calculator to work out just the tax you owe on your taxable income for the full income year.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2025 Tax Brackets The Best To Live A Great Life, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Use the simple tax calculator to work out just the tax you owe on your taxable income for the full income year.

Source: ednafletcher.pages.dev

Source: ednafletcher.pages.dev

Uk Tax Calculator 2025 Opal Vivyan, 9, 2025 washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year. Credits, deductions and income reported on other forms or schedules.

Source: payroll.utexas.edu

Source: payroll.utexas.edu

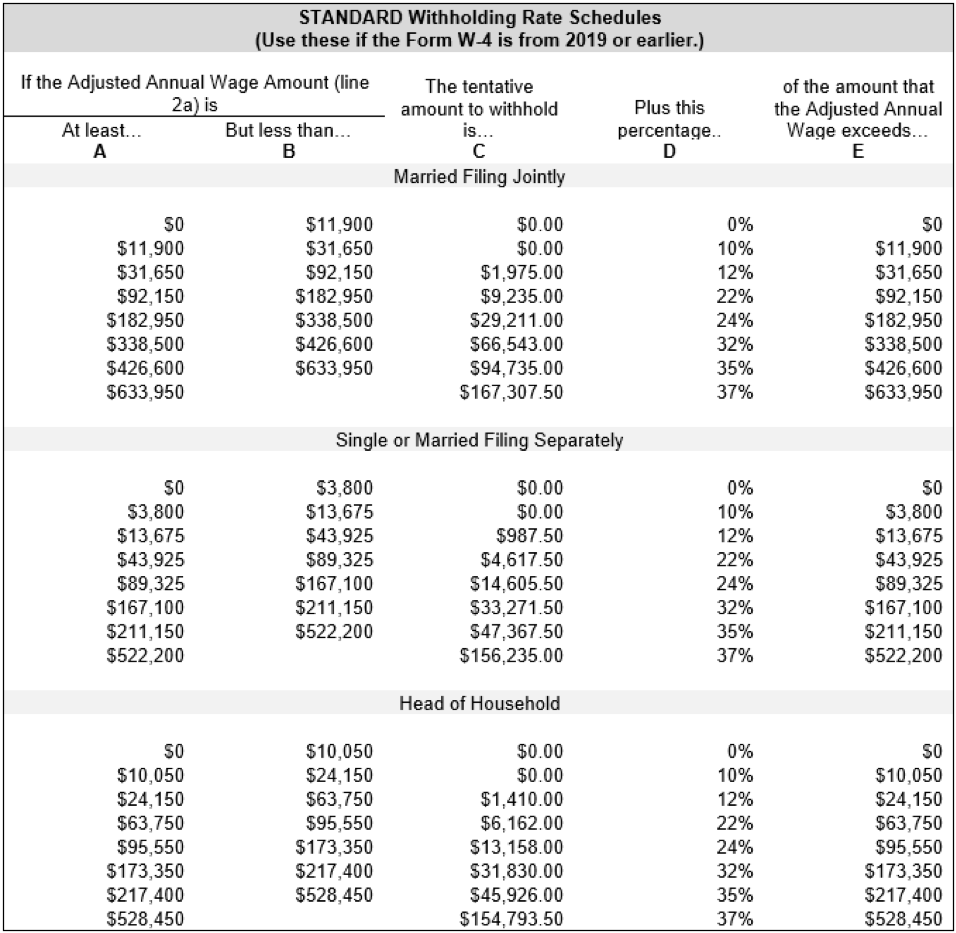

Calculation of Federal Employment Taxes Payroll Services The, How much tax you’ve paid in the current tax year; Federal payroll tax rates for 2025 are:

Source: www.marca.com

Source: www.marca.com

Tax payment Which states have no tax Marca, In 2025, a single filer making $45,000 of taxable income pays a 10% tax rate on $11,000 of their earnings, a 12% tax rate on the portion of the earnings between $11,001 and $44,725, and a 22%. As your income goes up, the tax rate on the next.

Source: arturowbryant.github.io

Source: arturowbryant.github.io

Us Spending Pie Chart, 9, 2025 washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year. 10 percent, 12 percent, 22.

Source: haipernews.com

Source: haipernews.com

How To Calculate Your Marginal Tax Rate Haiper, R141 250 r135 150 75 and older: You pay tax as a percentage of your income in layers called tax brackets.

9, 2025 Washington — The Internal Revenue Service Today Announced The Annual Inflation Adjustments For More Than 60 Tax Provisions For Tax Year.

1.45% for the employee plus.

We've Got All The 2025 And 2025.

Chargeable income in excess of $500,000 up to $1 million will be taxed at 23%, while that in excess of $1 million will be taxed at 24%;