Tax Rate 2024 Married Filing Jointly

Tax Rate 2024 Married Filing Jointly. In 2023, married filing separately taxpayers get a standard deduction of $13,850. Married filing jointly for 2024 taxable income of.

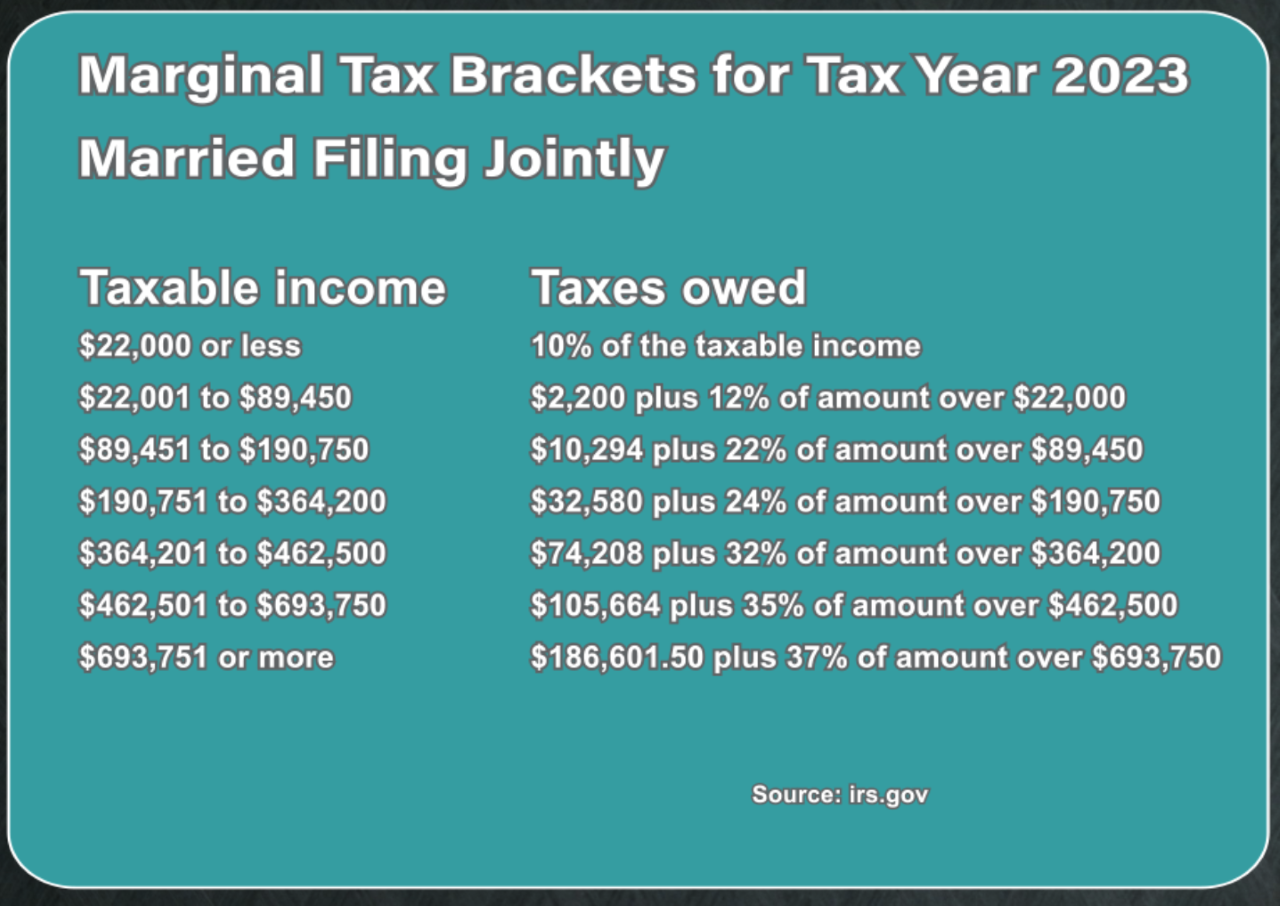

There are seven income tax rates for the 2024 tax year, ranging from 10% to 37%. Tax rate single filers married couples filing jointly married couples filing separately head of household;

With The Upcoming Tax Year, It’s Crucial For U.s.

24% for incomes over $100,525 ($201,050 for married couples filing jointly) 22% for incomes over $47,150 ($94,300 for married couples filing jointly)

Having A Grasp Of The Tax Rates And Income.

Compare this to the $27,700 that those who.

How Much You Owe Depends On Your Annual Taxable Income.

Images References :

Source: www.bluechippartners.com

Source: www.bluechippartners.com

What Is My Tax Bracket 2022 Blue Chip Partners, See current federal tax brackets and rates based on your income and filing status. 24% for incomes over $100,525 ($201,050 for married couples filing jointly) 22% for incomes over $47,150 ($94,300 for married couples filing jointly)

Source: hopevirals.blogspot.com

Source: hopevirals.blogspot.com

Married Filing Jointly Tax Brackets 2022 2022 Hope, In 2023, married filing separately taxpayers get a standard deduction of $13,850. In 2023, the irs married filing jointly tax brackets are:

Source: www.youtube.com

Source: www.youtube.com

How to fill out IRS Form W4 Married Filing Jointly 2022 YouTube, 10% on income $0 to $20,550; 24% for incomes over $100,525 ($201,050 for married couples filing jointly) 22% for incomes over $47,150 ($94,300 for married couples filing jointly)

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, In 2023, married filing separately taxpayers get a standard deduction of $13,850. The 2024 tax brackets apply to income earned this year, which is reported on tax returns filed in 2025.

Source: e.tpg-web.com

Source: e.tpg-web.com

Anh Le's Tax Planning Guide 2022 Tax Planning Guide Brackets and Rates, 10% on income $0 to $20,550; This applies to taxes filed by april 15, 2024, or by oct.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, The 2024 tax brackets apply to income earned this year, which is reported on tax returns filed in 2025. 15, 2024, with an extension.

Source: patiencewliz.pages.dev

Source: patiencewliz.pages.dev

20242024 Tax Calculator Teena Genvieve, Separate tax returns may result in more tax. Married filing jointly or married filing separately.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Compare this to the $27,700 that those who. Having a grasp of the tax rates and income.

Source: invomert.blogspot.com

Source: invomert.blogspot.com

2021 Tax Brackets Married Filing Jointly INVOMERT, Compare this to the $27,700 that those who. Married filing jointly or married filing separately.

Source: oakharvestfg.com

Source: oakharvestfg.com

IRS Tax Brackets AND Standard Deductions Increased for 2023, In the 2023 tax year, the married filing jointly tax brackets are as follows: In 2024, it is $14,600 for single taxpayers and $29,200 for married taxpayers filing jointly, slightly increased from 2023 ($13,850 and $27,700).

10% On Income $0 To $20,550;

Married persons can choose to file separately or jointly.

In This Article, We Will Explore The Tax Brackets For Married Couples Filing Jointly In 2023 And 2024, Providing You With Valuable Insights To Navigate The Tax Landscape When Filing.

8 rows tax rate single filers married filing jointly or qualifying widow(er) married filing separately head of household;